SEC Files Lawsuit Against Ripple Over XRP Cryptocurrency

The SEC has filed a lawsuit against Ripple’s CEO Bradley Garlinghouse and co-founder Christian A. Larsen in federal district court in Manhattan and charges defendants with violating the registration provisions of the Securities Act of 1933 and seeks injunctive relief, disgorgement with prejudgment interest, and civil penalties.

SEC charges Ripple and two executives with conducting $1.3 billion unregistered securities offering https://t.co/3VP23RpSyV

— SEC (@SECGov) December 22, 2020

Complaint

The complaint alleges that Ripple raised funds, beginning in 2013, through the sale of digital assets known as XRP in an unregistered securities offering to investors in the U.S. and worldwide.

According to the complaint, in addition to structuring and promoting the XRP sales used to finance the company’s business, Larsen and Garlinghouse also affected personal unregistered sales of XRP totaling approximately $600 million.

The complaint also alleges that the defendants failed to register their offers and sales of XRP or satisfy any exemption from registration, in violation of the registration provisions of the federal securities laws.

“We allege that Ripple, Larsen, and Garlinghouse failed to register their ongoing offer and sale of billions of XRP to retail investors, which deprived potential purchasers of adequate disclosures about XRP and Ripple’s business and other important long-standing protections that are fundamental to our robust public market system.”

Stephanie Avakian, director of the SEC’s Enforcement Division“In 2017 and 2018, Ripple also entered into agreements with at least ten digital asset trading platforms—none of which were registered with the SEC in any capacity, and at least two of which have principal places of business in the United States—providing for listing and trading incentives with respect to XRP. Ripple paid these platforms a fee, typically in XRP, to permit the buying and selling of XRP on their systems and sometimes incentives for achieving volume metrics.”

SEC Lawsuit Page 25 of 71

Delisting’s, Halts & Liquidations

Swipe Wallet will be delisting $XRP for our USA users on January 5th 00:00 UTC. At this time, deposits and exchanging of $XRP will be disabled. Users will be able to withdraw their $XRP out by January 12th 00:00 UTC Thereafter, the $XRP Wallet will be disabled for USA users.

— Swipe (@SwipeWallet) December 29, 2020

Binance US Will Suspend XRP Trading and Deposits January 13th.

Binance.US users will not be able to deposit XRP as of January 13, 2021 at 10am EST. XRP withdrawals will not be affected at this time.

Bittrex (US)

Bittrex will remove XRP markets on Friday, January 15th, 2021 at 4PM (PST).

The following markets will be removed:

• BTC-XRP

• ETH-XRP

• USDT-XRP

• USD-XRP

#Bittrex Customers:

— Bittrex (@BittrexExchange) December 29, 2020

The $XRP markets will be removed on Friday, January 15th at 4:00PM PST.

Details: https://t.co/1mefjC1ziw

Coinbase

Coinbase to suspend XRP trading Tuesday, January 19, 2021, at 10 AM PST. Afterward, users will continue to retain access to their XRP funds.

“The trading suspension will not affect customers’ access to XRP wallets which will remain available for deposit and withdraw functionality after the trading suspension. Further, customers will remain eligible for the previously announced Spark airdrop (subject to approval in certain jurisdictions), and we will continue to support XRP on Coinbase Custody and Coinbase Wallet.”

Given the SEC’s recent action against Ripple, all XRP books have been moved to limit only and Coinbase plans to fully suspend trading in XRP on Tuesday, January 19, 2021, at 10 AM PST. Afterwards, users will continue to retain access to their XRP funds. https://t.co/izreZvgHNl

— Coinbase (@coinbase) December 28, 2020

OKCoin

OKCoin announced that it would soon be suspending trading and deposits of XRP.

“We have been closely monitoring the news surrounding the December 22nd SEC lawsuit against Ripple, the company behind XRP, and two of its key executives. As the lawsuit proceedings take place, we have determined it is the best course of action to suspend XRP trading and deposits on OKCoin effective January 4, 2021.“

On January 4th 2021 at 7:00 PM PST, we will suspend $XRP trading and deposits.

— OKCoin (@OKCoin) December 28, 2020

Read more: https://t.co/kwKN97xZJO

Bitstamp

Bitstamp located in the United Kingdom and ranked 27th in terms of average daily exchange volume in our database has announced that all they will halt all trading and deposits for all US customers on January 8, 2020.

In light of the SEC's recent filing alleging XRP is a security, we are going to halt XRP trading and deposits for all US customers on January 8, 2021. Other countries are not affected. Read more: https://t.co/RUGtkAjr08

— Bitstamp (@Bitstamp) December 25, 2020

OSL

OSL Hong Kong Trading Platform OSL Suspends XRP Services.

“As part of OSL’s rigorous compliance program, digital assets are subjected to regular due diligence reviews to assess their suitability for trading on our platform,” Wayne Trench, CEO of OSL.

Please note: In light of US Securities & Exchange Commission’s enforcement action against Ripple Labs & 2 of its executives, we have suspended all #XRP payment in and trading services on the OSL platform, effective immediately and until further notice.https://t.co/EXJJEHMawn

— OSL (@osldotcom) December 23, 2020

Grayscale

“The Fund has removed XRP and used cash proceeds to purchase the remaining Fund Components: Bitcoin, Ethereum, Litecoin, and Bitcoin Cash“

3/ $XRP was removed following DLC Fund's Quarterly Review (12/31/20). No others assets qualified for inclusion. The below table highlights DLC Fund’s weightings as of January 4, 2021: $BTC $ETH $BCH $LTC pic.twitter.com/g3QQEf0kd8

— Grayscale (@Grayscale) January 5, 2021

Grayscale Investments Commences Dissolution of Grayscale XRP Trust

Beaxy

Beaxy located in Saint Kitts and Nevis and ranked 249th in terms of average daily exchange volume in our database has announced that they a halt on all XRP trades.

The SEC has charged @Ripple with conducting an unregistered security sale.

— Beaxy Exchange (@BeaxyExchange) December 22, 2020

Due to this, #Beaxy has halted trading for XRP pending further news. $XRP withdrawals will remain enabled until further notice. pic.twitter.com/lVVqXJPdPP

Crypto.com announced Effective January 19, 2021 at 10am UTC, XRP will be delisted and trading suspended from the Crypto.com App in the U.S. Below please find how the delisting of XRP will be handled across Crypto.com’s products.

$XRP will be delisted from the https://t.co/vCNztABJoG App in the U.S. effective Jan 19th, 2021 at 10am UTC.

— Crypto.com (@cryptocom) December 29, 2020

Details: https://t.co/aja3yrhxCe

CrossTower

“On Tuesday, December 22nd, CrossTower made the decision to remove XRP from its US-based trading platform – effective immediately. Non-US customers using CrossTower ‘s global trading platform remain unaffected by this decision and can still trade XRP“

Bitwise

Galaxy Digital

B2C2

The London-based trading firm that helps brokerages, exchanges, and fund managers make cryptocurrency transactions B2C2 halted the trading of XRP with U.S.-based counterparties

Jump Trading

Jump Trading, the Chicago-based high-frequency trader has stopped making markets in XRP, according to sources. The company has not released an official announcement.

SimpleX

Crypto payment processor SimpleX a solution that is also used to manage financial trading instruments such as Letters of Credit, Standby Letters of Credit, Performance Bonds, and Bank Guarantees using the capabilities of blockchain technology and Simplex’s partners are also no longer accepting XRP transactions in wake of SEC lawsuit.

MoneyGram

“MoneyGram has continued to utilize its other traditional FX trading counterparties throughout the term of the agreement with Ripple, and is not dependent on the Ripple platform to accomplish its FX trading needs”.

“As a reminder, MoneyGram does not utilize the ODL platform or RippleNet for direct transfers of consumer funds – digital or otherwise. Furthermore, MoneyGram is not a party to the SEC action.”

eToro to suspend XRP trading in the US

Given the U.S. Securities and Exchange Commission’s (SEC) recent lawsuit against Ripple Labs, Inc., eToro USA LLC (eToro) has decided to prohibit purchases of XRP on the eToro platform and to prohibit any conversion of XRP held in a customer’s eToro Wallet beginning on January 3 at 12pm Eastern Standard Time. Customers with existing XRP positions will have until January 24 at 12pm Eastern Standard Time to close such positions by entering sell orders on the eToro platform. eToro reserves the right to suspend any services at any time, including earlier than January 3 at 12pm Eastern Standard Time, if we determine that market, regulatory, or other conditions warrant such action.

eToro to suspend XRP trading in the US https://t.co/cCHIV7u9BE

— eToro US (@eToroUS) December 31, 2020

Blockchain.com

“Due to the SEC’s recent action against Ripple Labs, Blockchain.com will halt XRP trading beginning Thursday, January 14th at 11:59pm GMT. For all customers who have XRP balances, you will continue to have access to your XRP to send after we halt trading, but we will no longer support receiving more XRP in the Exchange.”

iTrustCapital

Self-Directed IRA Technology provider iTrustCapital platform will be unable to support trading in XRP after 5:00 PM on January 8th.

Voyager

Voyager will suspend XRP trading effective Monday, Jan. 18, at 12:00 p.m. New York time.

Developing…

Kraken

Kraken announced it’s halting trading of the XRP token for U.S. residents no later than January 29, 2021, at 5pm PT (January 30, 2021 at 1:00 UTC).

Kraken to halt XRP trading for U.S. residents, ciiting the recent SEC filing against Ripple Labs.

— CoinDesk (@CoinDesk) January 15, 2021

by @KReyofCoinDesk https://t.co/ftJa8jO1pk

AnchorUSD

📢 1/4 In light of recent SEC filing against Ripple Labs, Inc., we will halt XRP trading on January 29th, 2021 at 10am PT.

— AnchorUSD (@AnchorUSD) January 23, 2021

Legal Filings

- SEC Lawsuit

- SEC Amended Complaint

- Sec Lawsuit Notes

- Ripple’s Wells Submission

- MEMORANDUM IN SUPPORT

- XRP Holders File Writ of Mandamus

- Coinbase Class Action Suit

- Pretrial Date SEC .v Ripple

- Pretrial Date SEC .v Ripple

- Tetragon Lawsuit

- Toomey .V Ripple

- Ripple . V SEC Case Management Order

- Ripple . V SEC Case Management Order

- Rosen Law Suit

- "XRP Hodl'ers" Motion Denied

- SEC's Reply to XRP Holder's Motion to Intervene

- Motion to Seal Exhibits

(Pg. 13 of 71 Line 69) While Ripple touted the potential future use of XRP by certain specialized institutions, a potential use it would deploy investor funds to try to create, Ripple sold XRP widely into the market, specifically to individuals who had no “use” for XRP as Ripple has described such potential “uses” and for the most part when no such uses even existed.

(Pg. 13 of 71 Line 70) Ripple also lacked the funds to pay for these endeavors and for its general corporate business expenses, which for 2013 and 2014 already exceeded $25 million, without selling XRP.

(Pg. 14 of 71 Line 76) In 2017, Defendants also began accelerating Ripple’s sales of XRP because, while Ripple’s expenses continued to increase (reaching nearly $275 million for 2018), its revenue outside of XRP sales did not.

(Pg. 14 of 71 Line 77) Starting in 2016, Ripple began selling two software suites, xCurrent and xVia, from which it has earned approximately $23 million through 2019, though neither uses XRP or blockchain technology. Ripple raised about $97 million in sales of equity securities through 2018 and an additional $200 million in 2019. In other words, the overwhelming majority of Ripple’s revenue came from its sales of XRP, and Ripple relied on those sales to fund its operations.

(Pg. 14 of 71 Line 79) Ripple sold at least 3.9 billion XRP through Market Sales for approximately $763 million USD.

(Pg. 14 of 71 Line 79) Ripple sold at least 4.9 billion XRP through Institutional Sales for approximately $624 million USD, also to fund Ripple’s operations, for a total of at least $1.38 billion USD in Market and Institutional Sales alone.

(Pg. 15 of 71 Line 85) Larsen and his wife sold over 1.7 billion XRP to public investors in the market. Larsen and his wife netted at least $450 million USD from those sales.

(Pg. 15 of 71 Line 86) Garlinghouse sold over 321 million XRP he had received from Ripple to public investors in the market, generating approximately $150 million USD from those sales.

(Pg. 18 of 71 Line 104) At least seven of the institutional investors—including some described below—bought XRP at discounts between 4% and 30% to the market price.

(Pg. 18 of 71 Line 106) By selling at discounts to market prices, Ripple incentivized these buyers to seek to sell their XRP into the public markets in order to realize what was essentially a guaranteed profit.

(Pg. 18 of 71 Line 108) On June 12, 2017, Larsen and others employees met with an investment fund (“Institutional Investor A”), which ripple Agent-2 described in a June 12, 2017 email to Ripple Agent-3 as “a $12B [$12 billion] alternative asset hedge fund based out of New York.

(Pg. 19 of 71 Line 109) In 2017, Ripple sold approximately 14.8million XRP for $2.1 million to Institutional Investor A, without restricting Institutional Investor A’s ability to resell this XRP into public markets in any way, at price discounts of up to 30% below XRP market prices.

(Pg. 21 of 71 Line 125) Ripple issued at least 324 million XRP as fees, rebates, and incentives to entities associated with ODL, without restricting the ability of these entities to resell the XRP received as incentives into public markets. This XRP was valued at approximately $67 million at the time of Ripple’s payments.

(Pg. 25 of 71 Line 140) “Services and Marketing Agreement” with one entity promised, “certain development services to promote technologies of interest to Ripple.” The agreement provided that the entity would receive a bi-monthly “development service fee” of 5 million XRP and could identify additional parties that could receive XRP as incentives— provided that these additional parties agreed to abide by Ripple-mandated parameters for their XRP trading volumes. By August 2020, Ripple had paid the entity at least 364 million XRP, of which the entity had distributed 178 million to other parties, typically approved by Ripple.

(Pg. 25 of 71 Line 140) Ripple also entered into agreements with at least ten digital asset trading platforms—none of which were registered with the SEC in any capacity, and at least two of which have principal places of business in the United States—providing for listing and trading incentives with respect to XRP. Ripple paid these platforms a fee, typically in XRP, to permit the buying and selling of XRP on their systems and sometimes incentives for achieving volume metrics.

(Pg. 26 of 71 Line 149) Ripple tried repeatedly and unsuccessfully to persuade that digital asset trading firm to “list XRP on [its] exchange” by offering to “cover implementation costs, paying rebates, [and] brokering intros to large XRP holders for custody.” Undaunted by these initial failures, Ripple Agent-3 emailed the two owners of the firm directly in July 2017, copying Garlinghouse, and asked: “Does a $1M cash payment move the needle for a Q3 listing?”

(Pg. 28 of 71 Line 161) From April 2017 through December 2019, Garlinghouse sold over 321 million of his XRP, for approximately $150 million, to the public through digital asset trading platforms or other intermediaries. Beginning in December 2017, Garlinghouse used the Market Maker, who deployed trading bots on multiple, worldwide digital asset trading platforms, to sell his XRP to the public.

(Pg. 30 of 71 Line 117) Ripple also directed the Market Maker to buy XRP in the open market with the goal of “[t]arget[ing] $0.008 incrementally over the course of 2 days” while “[c]ap[ping] activity at 5% of daily trading volume[,]” among other things.

(Pg. 30 of 71 Line 178) A Ripple vice president of finance (the “VP of Finance”) then asked Garlinghouse and Ripple Agent-3 “if [they] discussed whether we should turn off the buying now with this news and the higher volume?” Ripple Agent-3 responded: “The thesis . . . is to show a period of consistent buying from an account that is known to be a consistent seller. The intended impact of the buying is not to move the price but rather to provide confidence in the market, which in turn will move the price.”

(Pg. 31 of 71 Line 183) VP of Finance, after consulting with Garlinghouse and Larsen and obtaining Garlinghouse’s “go ahead,” directed the Market Maker to “keep the buying light [the day after the announcement] and then do the bigger slug starting Sunday.” The Market Maker agreed.

(Pg. 31 of 71 Line 184) Market Maker reported to Ripple that it had “spent approximately $200K of the second tranche” and recommended a strategy “to make aggressive markets” going forward, to which the VP of Finance agreed.

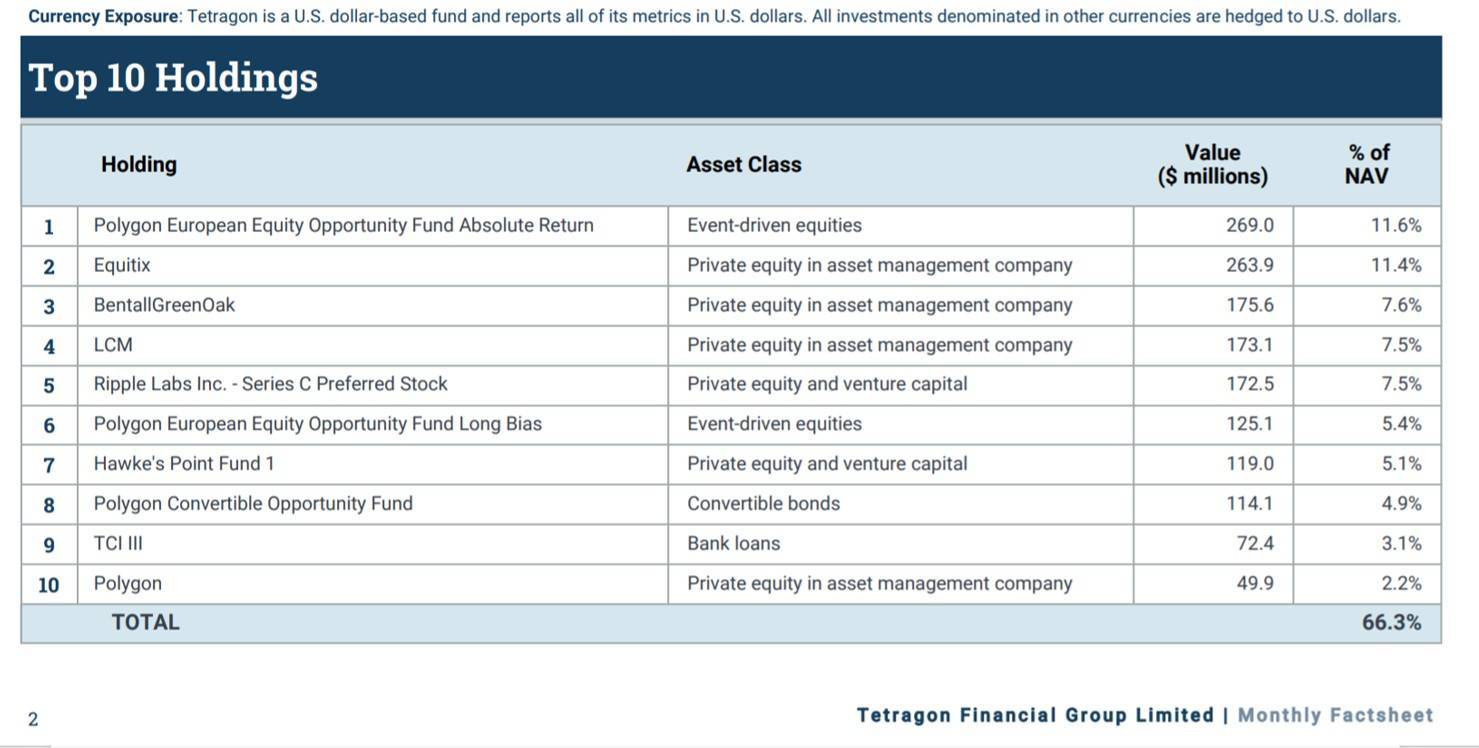

Tetragon Financial Group

UK-based investment firm Tetragon Financial Group, is suing Ripple after a recent complaint by the U.S. Securities and Exchange Commission (SEC) in Delaware Chancery Court, seeking to “enforce its contractual right to require Ripple to redeem” Series C preferred stock, according to a report.

Copies of the filings were not available at the time of this post.

Tetragon XRP holdings

Tyler Toomey filed a lawsuit against the company after losing 50% value of his investment in XRP.

The filing mention that Toomy purchased 135 XRP in November 2020 and sold in two transactions in December with a loss of nearly 50%. Toomey alleged that Ripple made billions of dollars by selling unregistered XRP tokens in the country.

Ripple Labs and SEC Joint Letter Rules Out Possibility of a Settlement

Ripple Labs and SEC Joint Letter Rules Out Possibility of a Settlement

LAW FIRM, Files Securities Class Action Lawsuit on Behalf of MoneyGram International, Inc. Investors; Encourages Investors With Losses Over $100K to Secure Counsel Before Important Deadline – MGI

Rosen Law Firm, a global investor rights law firm, announces it has filed a class action lawsuit on behalf of purchasers of the securities of MoneyGram International, Inc. (NASDAQ: MGI) between June 17, 2019 and February 22, 2021, inclusive (the “Class Period”). A class action lawsuit has already been filed. If you wish to serve as lead plaintiff, you must move the Court no later than April 30, 2021.

SO WHAT: If you purchased MoneyGram securities during the Class Period you may be entitled to compensation without payment of any out of pocket fees or costs through a contingency fee arrangement.

WHAT TO DO NEXT: To join the MoneyGram class action, go to http://www.rosenlegal.com/cases-register-2046.html or call Phillip Kim, Esq. toll-free at 866-767-3653 or email [email protected] or [email protected] for information on the class action. A class action lawsuit has already been filed. If you wish to serve as lead plaintiff, you must move the Court no later than April 30, 2021. A lead plaintiff is a representative party acting on behalf of other class members in directing the litigation.

WHY ROSEN LAW: We encourage investors to select qualified counsel with a track record of success in leadership roles. Often, firms issuing notices do not have comparable experience or resources. The Rosen Law Firm represents investors throughout the globe, concentrating its practice in securities class actions and shareholder derivative litigation. Rosen Law Firm has achieved the largest ever securities class action settlement against a Chinese Company. Rosen Law Firm was Ranked No. 1 by ISS Securities Class Action Services for number of securities class action settlements in 2017. The firm has been ranked in the top 3 each year since 2013 and has recovered hundreds of millions of dollars for investors. In 2019 alone the firm secured over $438 million for investors. In 2020 founding partner Laurence Rosen was named by law360 as a Titan of Plaintiffs’ Bar. Many of the firm’s attorneys have been recognized by Lawdragon and Super Lawyers.

DETAILS OF THE CASE: According to the lawsuit, defendants throughout the Class Period made false and/or misleading statements and/or failed to disclose that: (1) XRP, the cryptocurrency that MoneyGram was utilizing as part of its Ripple partnership, was viewed as an unregistered and therefore unlawful security by the SEC; (2) in the event that the SEC decided to enforce the securities laws against Ripple, MoneyGram would be likely to lose the lucrative stream of market development fees that was critical to its financial results throughout the Class Period; and (3) as a result, defendants’ public statements were materially false and/or misleading at all relevant times. When the true details entered the market, the lawsuit claims that investors suffered damages.

To join the MoneyGram class action, go to http://www.rosenlegal.com/cases-register-2046.html or call Phillip Kim, Esq. toll-free at 866-767-3653 or email [email protected] or [email protected] for information on the class action.

No Class Has Been Certified. Until a class is certified, you are not represented by counsel unless you retain one. You may select counsel of your choice. You may also remain an absent class member and do nothing at this point. An investor’s ability to share in any potential future recovery is not dependent upon serving as lead plaintiff.

Proposed Intervenors, Jordan Deaton, James Lamonte, Tyler Lamonte, Mya Lamonte, Mitchell Mckenna, Kristiana Warner and all other similarly situatedXRP holders(“XRP Holders”) motion to intervene in the SEC v. Ripple lawsuit has been DENIED without prejudice to renewal in a motion that complies with Rule III(A) of the Court’s Individual Practices in Civil Cases.

For the foregoing reasons, the Court should deny the Motion to Intervene and deny

Defendants’ request that Movants participate as amici in this action.

The SEC has filed its Motion to Seal exhibits in connection with the dispute over the SEC’s Interrogatory Responses regarding the application of the Howey Test to sales of XRP over the last 8 years.

Ripple Responses

- XRP is not an “investment contract.” XRP holders do not share in the profits of Ripple or receive dividends, nor do they have voting rights or other corporate rights. Purchasers receive nothing from their purchase of XRP except the asset. In fact, the vast majority of XRP holders have no connection or relationship with Ripple whatsoever.

- Ripple (our company) has shareholders; if you want to invest in Ripple, you do not buy XRP but rather shares in Ripple.

- Unlike securities, the market value of XRP has not been correlated with Ripple’s activities. Instead, the price of XRP is correlated to the movement of other virtual currencies.

Ripple Labs files 93 page response to SEC’s allegations.

Ripple Labs files Freedom of Information Request

Ripple files a Freedom of Information request with the SEC, for a release of documents concerning the SEC’s determination that Bitcoin and Ethereum are not securities.

Ripple has spent 8 years working tirelessly to build an incredible company transforming global payments. Our mission doesn’t stop! Here’s what I sent to employees yesterday + our lawyers’ reaction to today’s SEC filing. https://t.co/wGHW4hCW2T

— Brad Garlinghouse (@bgarlinghouse) December 23, 2020

Garlinghouse said Ripple plans to fight the case in a series of Twitter comments yesterday.

Today, the SEC voted to attack crypto. Chairman Jay Clayton – in his final act – is picking winners and trying to limit US innovation in the crypto industry to BTC and ETH. (1/3) https://t.co/r9bgT9Pcuu

— Brad Garlinghouse (@bgarlinghouse) December 22, 2020

Ripple tried to settle charges of conducting unregistered securities transactions with the U.S. Securities and Exchange Commission (SEC) before the federal regulator sued it in December, according to CEO Brad Garlinghouse.

I’m not going to litigate the SEC’s unproven allegations on Twitter, and as you can imagine, there are new considerations to what can / should be said publicly after the litigation process starts. However, I would like to address 5 key questions I’ve seen. 1/10

— Brad Garlinghouse (@bgarlinghouse) January 7, 2021

Our statement regarding recent market participant activity in response to the SEC’s lawsuit. https://t.co/IpQYeCuV5A

— Ripple (@Ripple) December 29, 2020

Ripple’s Statement on Yesterday’s Tetragon Filing

Our statement regarding Tetragon's filing: https://t.co/eHrq2v89WO

— Ripple (@Ripple) January 5, 2021